Isabella Mankis

Perceptions of Wealth Gap

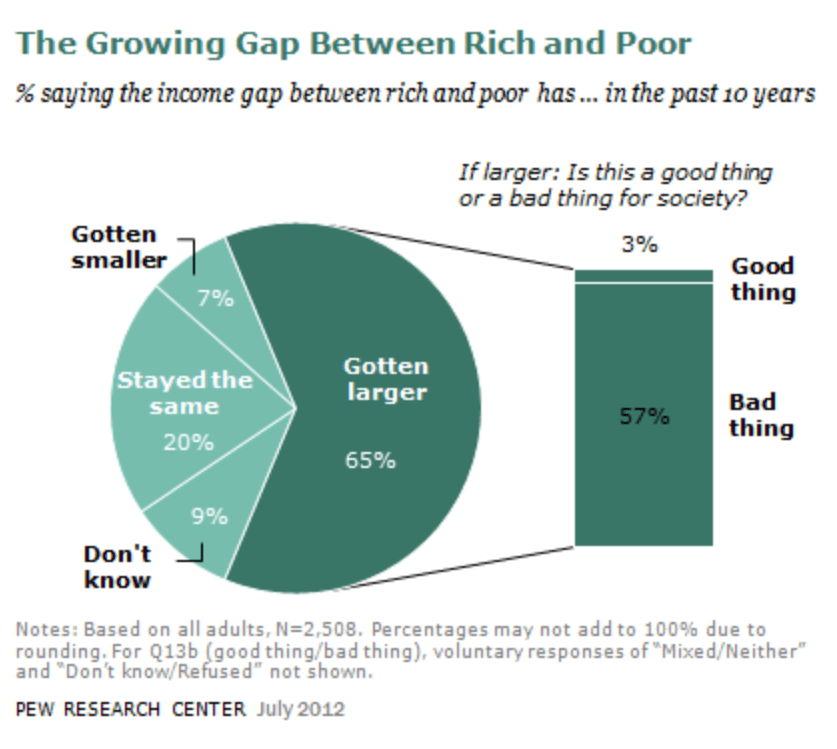

For this blog post, I would like to ask you to be patient and remain open-minded. Perceptions of the Wealth Gap are different from person to person. You might ask someone in the top 0.01% what they perceive it as and their answer could be, and probably will be, completely different from someone in the bottom 20%. There are many questions that come to mind when I think of the Wealth Gap and what that means to me. I would say I’m not in the bottom 20%. I’m not in the top 0.01% either. Some questions that come to mind for me are simply these…

What is the Wealth Gap?

What is Wealth?

How does the Wealth Gap affect people on opposite ends of the gap?

What are the causes?

What are the effects?

How can it end?

What can I do?

Now these questions I could answer for you very simply and quickly, which I absolutely will in due time. What I would like for you, as the reader, to do first is to re-read these questions and answer them for yourself. Go ahead, take your time. When you have finished answering these questions for yourself, go ahead and think outside of the box. What is your social class? Think of someone in a different social class and try to think of how they would answer these questions. How would a homeless man or woman answer these? How would a top CEO answer these?

I believe that asking these questions, getting those answers, and readjusting our views is the exact way that we can change perception on hot button issues like Wealth Gap. Not many people like talking about their financial standing or how they view their financial standing in respect to others, it’s a rather taboo subject. Although that is precisely what is needed to find solutions.

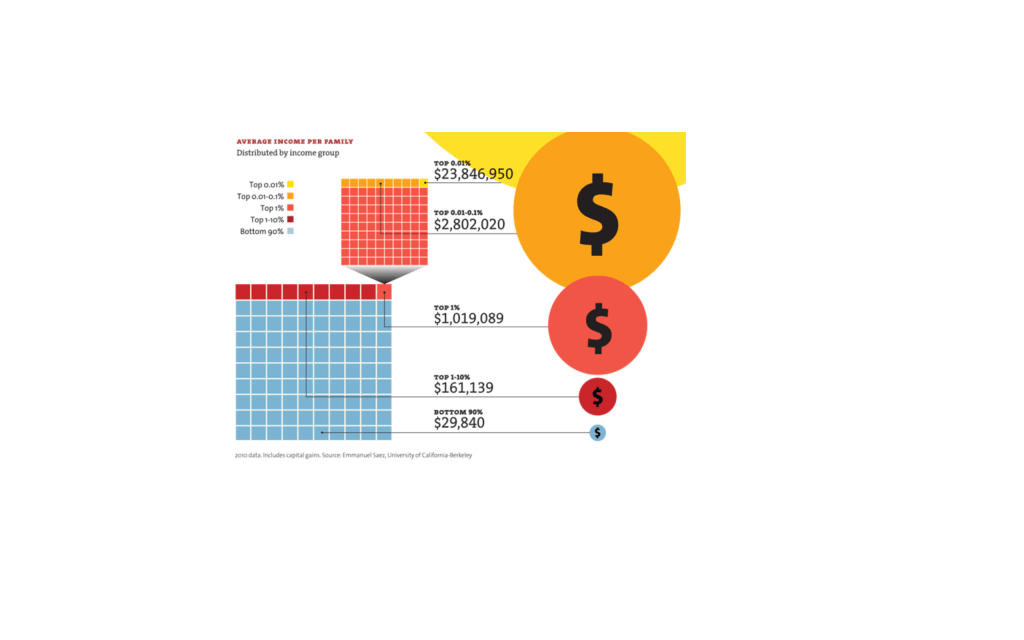

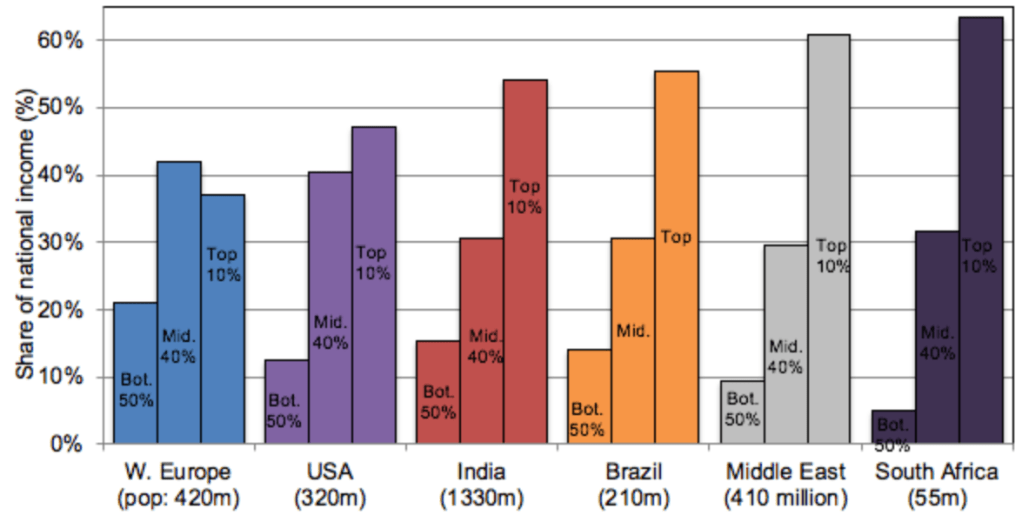

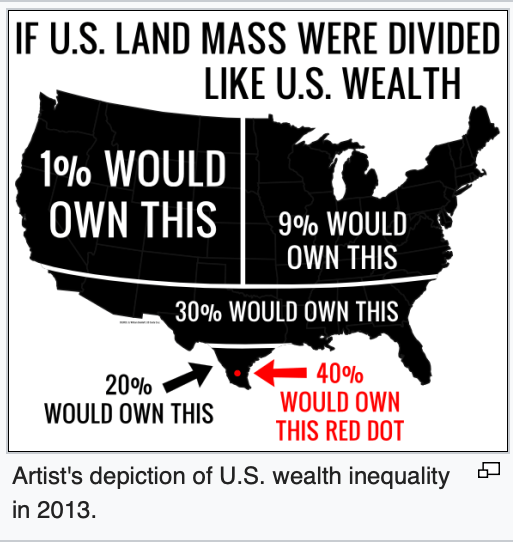

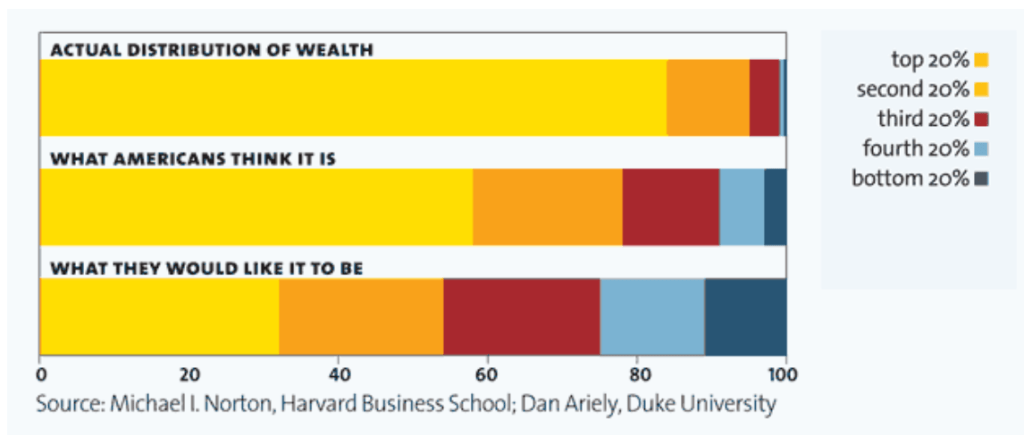

So back to the questions I previously asked, what is the Wealth Gap? Wealth Gap is the unequal distribution of assets among people. This could be in the form of money, real estate, stocks, or any other assets worth something.

What is Wealth? Many people will have different answers but most can be summed up to the accumulation of money in some form or another.

How does the Wealth Gap affect people on opposite ends of the Gap? Well, the short answer is that the people on the bottom end are funding people at the top. The people at the top can either reintroduce their wealth to society, or grow their wealth. If said wealth is reintroduced into society, that funds people at the bottom and helps society’s functioning as a whole. If funds are continually saved by the people in the top 1%, nothing is reintroduced to the economy and the Wealth Gap itself gets larger.

What are the causes? What are the effects? Certain things come into play with the Wealth Gap. There is what you are born into, psychological and mental factors, education, work experience, career interests, connections, and community. This may seem like a lot but it really isn’t. We are a product of our environment. Let’s think hypothetically of a kid from Detroit born into a family dealing with poverty. The family themselves are under financial stress, the city and neighborhood is unsafe, the school system does not have the resources to teach these students what the curriculum says, let alone life skills and how to be a successful student in college. It is up to the child to learn, but how can a child focus on school when they are under the stress of having to look over their shoulder every time they leave their home or school? On top of that, the fellow students are in the same situation and are being taught by the students before them how they should be acting, which is not normally well. By the time they are in high school, they would rather be working because having money is their idea of being successful. They turn their priorities to work, rather than school and that becomes their path. Of course, this is again hypothetical. My point is, without the proper environment, history is doomed to repeat itself. This hypothetical child may end up in a better position then what he was born into, but will they ever be in the top .1%?

How can it end? Because of what standards are for success, to be a top earner in the .1%, the most effective way of getting there would be to get a college degree. Plain and simple, a college degree gives you more than a piece of paper. When you are in a college environment, you are learning how to connect and communicate with your peers and colleagues, becoming more educated yourself, finding a career path that actually interests you, and surrounding yourself with people that are interested in living productive lives. Putting yourself in this environment doesn’t guarantee that you will be in the top .1%, it doesn’t even guarantee that you will be out of the bottom 20%. It will increase your chances of getting a good job surrounded by educated individuals that are making at least middle class wages. It also broadens views of what interests the individual and what would bring them the most happiness out of life.

Our perception of the Wealth Gap is that the rich sit back and get richer. Although that has slight truth, the reason they have been able to reach that point is because of educating and overeducating themselves. Education is the key to success. It’s been quoted that CEO’s read an average of 60 books a year. That’s 5 books a month, and I’m guessing those aren’t Dr.Seuss books. Another key factor is reintroducing money into the economy. Jeff Bezo’s has a net worth of $129.9 billion and he is only spending $10 billion on looking into climate change. I can only dream of what I would do with $1 million let alone $129.9 billion. Recirculating money would help the lower class, strengthen the middle class, and in turn actually benefit the upper class.